By Anders Hove and Philipp Geres

The existence of voluntary green certificates enables companies and individuals to contribute to accelerating the energy transition, promoting market innovation and better integrating renewable energy consumption. The U.S. and Europe each have thriving markets for tradeable green certificates, called guarantees of origin (GO) in Europe and renewable energy certificates (RECs) in the U.S.

Each region has a mixture of incentives for renewable energy, and voluntary purchase of renewable energy takes many forms. In Europe, GOs emerged as a way for companies to prove the origin of renewable energy claims, not as an incentive to encourage renewable production. In Germany, companies seeking to source green power often purchase GOs from other countries, since German law forbids projects claiming a feed-in tariff or premium and a GO simultaneously.

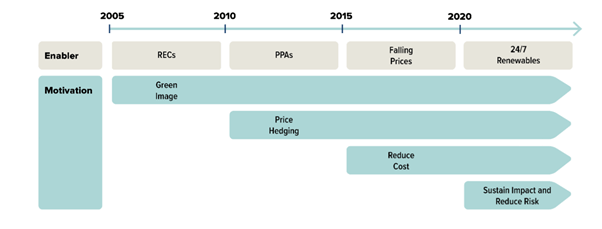

As subsidies decline and renewables become more competitive, green certificates are likely to rise in importance, and new products are emerging to encourage this, such as 24/7 matching of renewable production and consumption.

U.S. voluntary renewable trading increasingly diverse and more demanding

- U.S. has an active market for voluntary renewable energy purchases, enabling interstate and cross-regional transactions that couldn’t take place physically.

- The price for RECs remains low, due to the competitive price of renewable energy, but voluntary purchases of renewables, especially by PPAs and Virtual PPAs, have likely propelled the market for these technologies, given the absence of a national requirement.

- Renewable tracking systems are an essential component of the national market, and provide buyers with consistent and accurate information to prevent double-counting.

- Tracking systems are beginning to offer more diverse products, and there is an emerging trend towards matching power demand with renewable output 24/7, which provides a signal for both energy storage and renewable production at times of greatest demand. This helps resolve a problem with ordinary green certificates, which boost demand for the lowest-cost renewables without considering the time of production, potentially worsening renewable integration issues.

Why did the U.S. develop green certificates (RECs)?

Voluntary procurement and trading of renewable energy has a long history in the United States, and today the country has a wide variety of different green power products and systems in place. The Renewable Energy Certificate, or REC, began in the 1990s when the U.S. Environmental Protection Agency (U.S. EPA) set out to comply with an executive order from President Bill Clinton directing federal agencies to procure more renewable energy. Given that the EPA had facilities throughout the U.S., many of which were small offices, the EPA sought a way to procure renewable energy flexibly throughout the country. Working with non-governmental organizations and eventually also with private companies seeking to procure renewables, the EPA established the Green Power Partnership and completed the first voluntary REC transaction in 2000.[1]

Around the same time, many U.S. states began to establish renewable energy mandates for electric utility companies—many of which have operations in several states. As of 2020, 30 states have renewable portfolio standards.[2] Some states with renewable mandates chose to adopt tradeable certificates to enable utilities to comply with these mandates at a lower cost, while enabling regulators to track and prove that renewable energy produced to meet a mandate in one state is not double counted to meet mandates elsewhere. As a result, the U.S. today has markets for two separate types of renewable certificates: mandatory RECs and voluntary RECs.

Who tracks RECs and are they compatible?

Today, most RECs in the U.S. are a part of a regional tracking system, typically an entity associated with one of the regional transmission operators (RTOs) or independent system operators. Examples of such tracking systems include M-RETS (the Midwest Regional Tracking System), the Generation Attribute Tracking System in the PJM Interconnection, and the Western Renewable Energy Generation Information System (WREGIS). The company APX has a tracking system for states or territories not participating in any regional tracking system.[3] Generators that register in one territory typically are not permitted to register in others to prevent double counting. While different tracking systems may contain different levels of detail on generation attributes, the common origin of voluntary REC markets in the U.S., and the demand for trading such credits nationally, means that the voluntary RECs and tracking systems are all sufficiently consistent to constitute a national market.

How large is the market for RECs?

According to data from the U.S. National Renewable Energy Laboratory (NREL), in 2019 green power purchases accounted for 164 million kWh, or 4% of U.S. electricity sales and 32% of non-hydro renewables.[4] That is over four times the amount sold in 2010, and likely has continued to rise over the past two years. At the same time, voluntary REC prices remain quite low, often under US$ 1/MWh, reflecting the low cost difference of wind and solar relative to power prices.[5] For mandatory RECs to meet state mandates, the cost has been even lower, since many states have already met their mandates.[6]

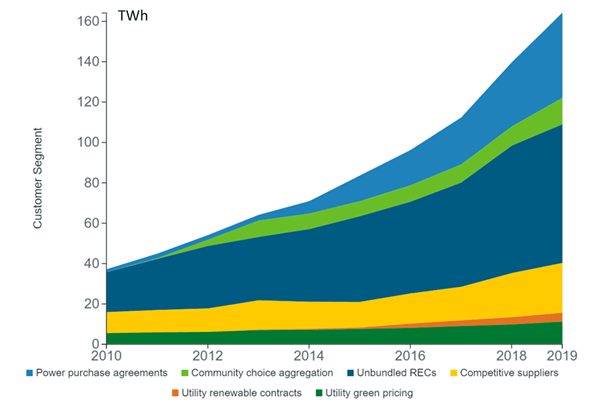

Sales of voluntary green power in the U.S. (TWh)

How do RECs relate to PPAs?

One of the main factors driving the voluntary green power market has been a wider variety of products available to different types of customers, along with the decline in renewable costs. Over the past decade, the largest rising component of green power sales has been via power purchase agreements. Whereas initially many such contracts were direct, physical power purchases from a generator and a purchasing company that needed the electricity, in recent years more PPAs are virtual. Under a virtual PPA, the renewable generator sells power into the local grid, while the purchaser pays the difference between the grid cost and the agreed PPA price.

The virtual PPA enables companies located in the coastal regions to purchase renewable electricity where it is least expensive. Indeed, for both RECs and PPAs, green power is now a national market: many of the companies that purchase green power are located in Texas, California, and New York, while the sellers of renewable electricity are located throughout the country, often in the Plains states or Midwest.[8]

For both the physical and virtual PPA, the RECs produced by the generator are transferred to the purchaser of the PPA and retired, to prevent double-counting. Companies making clean energy claims typically rely on third-party certification to demonstrate they are meeting standards. The largest and best known of these programs is Green-e Energy, administered by the nonprofit Center for Resource Solutions. Participating sellers of renewable energy have to meet CRS eligibility requirements and undergo annual audits to ensure that RECs are not being double counted or double sold and that the consumer is receiving RECs created when and where the seller claimed. The audits are performed by certified accountants and auditors following specific audit protocols, reviewed by CRS, and posted to the Green-e website.[9]

Why are new REC products emerging?

More different types of companies have been joining the market, and they are demanding a wider variety of green power products—for example, placing a higher value on avoided carbon emissions, storage, and local employment.[10] This reflects not only increased corporate interest in going green, but also higher pressure from investors, journalists, and the public. Media reports sometimes call into question whether corporate commitments to 100% clean energy are real, and companies are responding by demanding more from generators and regulators who offer RECs and PPAs.

One trend that could transform the REC market is the concept of 24/7 clean energy. In 2021, Google announced the first ever purchase of time-matched RECs, the first step in fulfilling the company’s 2030 goal of obtaining all its electricity from renewables produced at the same time as the company’s consumption.

What are the pros and cons of time-matching REC production with market demand?

24/7 time-matched RECs are only available for now in one market in the Midwest, known as MISO (the Midwest Independent System Operator). M-RETS introduced hourly tracking for all RECs registered with its system starting in 2019.[11] In a detailed study of hourly REC trading, M-RETS cited a number of important advantages. Matching hourly load helps reduce the cost of grid integration of renewables, because without hourly matching, buyers of RECs (which, are a financial instrument, not a physical purchase of electricity) will tend to purchase the cheapest renewable energy, such as midday solar PV. This would tend to worsen the duck curve problem in California and other regions, where an oversupply of midday PV leads to both curtailment and excessive ramp rates in the early evening. Load-matching provides demand for renewable energy at the time it is needed physically, ensuring the financial instrument of the REC better matches the physical demand for energy. Thus, time-matched REC purchases provide an incentive for installation of storage or a more diverse array of renewable energy sources with a flatter energy generation profile—or one more matched to load. Load-matching provides valuable information to the market and to grid planners. Further, load matching works in both directions, providing an incentive for the user to adjust load during hours when renewable energy is scarce.

The evolution of corporate renewable energy procurement trends

That said, M-RETS also notes load-matched RECs do pose some difficulties: they involve greater complexity for both buyers and sellers, and could shift the focus of renewable procurement away from additionality and towards already-existing renewable sources such as hydro. In addition, if only some customers purchase time-matched RECs, this could lead to the perverse consequence of other RECs becoming even cheaper for those with no interest in time-matched RECs.

Academic writers have started to recognize the importance of shifting away from MWh and towards promotion of renewable energy produced at the right time. Writing in the academic journal Joule, Jacques de Chalendar and Sally Benson discuss the case of California, where procurement of new renewable energy in the middle of the day, when solar is already plentiful, can create demand for new power imports and fossil energy to meet the evening ramp.[13] Ensuring companies procure clean power—including storage—using hourly accounting has a far higher benefit for reducing carbon emissions in solar-dominated regions than pure 100% renewable energy targets.

EU: Guarantees of Origin are not a support instrument, but could gain importance in the future

- Guarantees of origin markets have operated in Europe for over a decade. Though national policies towards GOs have become more uniform, there remain several differences, resulting in price differentials across Europe.

- Since Germany does not permit wind and solar plants that received subsidies to claim GOs, companies such as green power marketers in Germany seeking to claim renewable purchases generally acquire GOs from other countries in Europe.

- Requiring full disclosure of GO purchases to claim renewable purchases is becoming more common and could bolster demand for voluntary GOs.

How did Europe develop the GO market?

The EU introduced Guarantees of Origin (GO) in its first Renewable Energy Directive in 2009. They replaced the previously existing certificates under the Renewable Energy Certification Standard that had been introduced in 2001. GO can be issued for each MWh of generated electricity. All GOs must contain information on each installation where energy was produced, whether it received investment support or runs under national support scheme, date and country of certificate issuance, and the date the installation became operational. Each GO has unique identification number. GOs also can include further information, such as about the renewable property of power. GOs can be issued for all kinds of energy sources, including nuclear and fossil. The GO system is voluntary, power producers can choose whether they wish to request issuance of GOs. However, power providers must disclose to customers where their electricity originates. Moreover, the EU originally did not introduce GOs with the purpose of supporting achievement of the energy targets of the EU and its member states but with the sole function of showing to final consumers that a specific amount of energy was produced from renewable sources.[14]

Who issues and tracks GOs?

GOs in the EU are issued and kept in registers by issuing bodies in each EU member state. 27 issuing bodies from 24 member states have formed the Association of Issuing Bodies (AIB) in 2002. The AIB has the aim to develop, use and promote a standardized system of energy certification for all energy carriers: the European Energy Certificate System, or EECS, so that GOs can be traded across all member states. The AIB Hub is the central point for transferring certificates between registries.[15]

The GO issuing, transfer and cancellation process works as follows: An account holder (energy producer) registers their production device online with the issuing body or other authorized bodies (such as the Transmission System Operator and/or Distribution System Operator), providing the required information. Once the device is registered, TSOs or DSOs collect meter readings monthly. Based on the readings, one GO per MWh is issued to the account. Power suppliers who have sold a certain amount of renewable energy purchase GOs to this amount, receive them on their account, and then cancel these GOs from the registry system.[16]

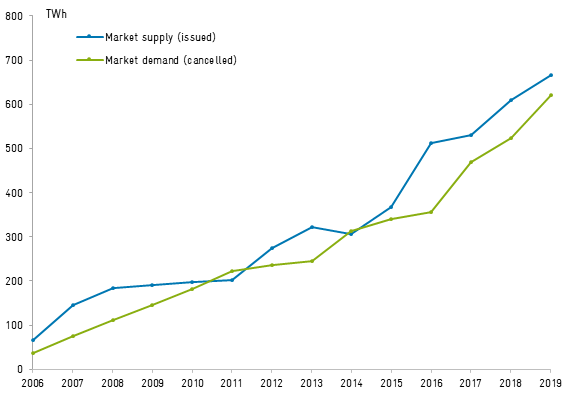

How large is the market for GOs?

The proportion of renewable energy in the EU energy mix in 2019 was 19.7%[17] and the proportion of renewable energy in the EU power mix 2020 was 38.2%.[18] In 2020, 760 TWh were traded as GO in the EU, which corresponds to 80% of the EU’s renewable electricity generation. Based on AIB data, in 2019, the shares of technologies among GO issuances was 54% hydro, 20% wind, 8% biomass, 8% fossil, 5% nuclear, 4% solar, 1% geothermal. The main GO issuers are Norway (19%), Spain (14%), Italy (13%), Sweden (10%), Switzerland (10%) Netherlands (8%), France (8%). Germany is the largest net importer of GOs, and the country imported around 88 TWh of GO in 2019. Norway was the largest net exporter, exporting 55 TWh of GO is 2019, followed by Italy (40 TWh). Prices can vary strongly by region and technology.[19]

In general, prices for GO have mostly been low, in 2020 remaining largely below Euro 0.5/MWh. Drivers of low prices have been identified as oversupply, especially due to high supply from hydropower especially from northern Europe and GO auctioning systems in some member states where prices are pushed down by GO for installations that also receive other forms of support or subsidies.[20]

Market development for renewables with Guarantees of Origin 2006-2019 (TWh)

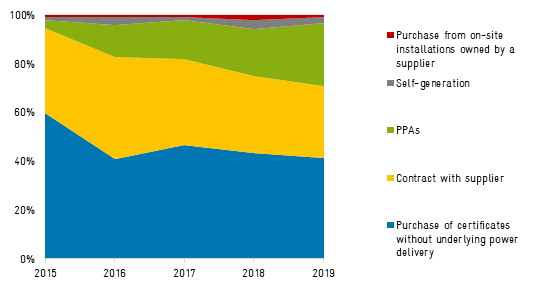

Evolution of renewable power sourcing methods used by RE100 members[i]

What is the purpose of GOs today and how is that changing?

The low GO prices reflect that policymakers introduced GO primarily as a tracking instrument for the origin of a specific amount of renewable power, rather than as an instrument to promote or accelerate renewable uptake. The Independent Commodity Intelligence Services (ICIS) suggests that making full disclosure of origin of consumed electricity mandatory for consumers would greatly increase demand for GO, and boost prices. The Netherlands and Austria already have taken that step.[23] Moreover, GO prices in the Netherlands increased after large power consumers committed to sourcing their GO from the Netherlands only, indicating that increased interest of power consumers in properties like local procurement can increase the value of GO. Additionality—which refers to whether the renewable energy represents an addition to what would have been produced otherwise—could lead to higher prices and make GO more of an inducement for new RE development.[24]

Why does Germany import the most GOs despite being a leading renewable producer?

Taking a closer look at the application of GO in Germany, it is striking that Germany import the most GO of any country despite having large amounts of domestic renewable energy. The paradox is due to Germany forbidding double marketing of green electricity from installations which already receive a feed-in tariff or feed-in premium under the country’s Renewable Energy Law (EEG)—which covers most wind and solar output. Germany considers EEG subsidies as a sufficient financial support for green electricity, and that allowing producers to market a GO on top of that support would represent a double counting of energy that would have already been produced. Given the low prices of GO, most generators consider the EEG support more attractive. Only operators of old installations not eligible for EEG funds have sought GO.

In Germany, GO are required for green power products sold to retail customers. Green power requires matching the power physically delivered to a consumer from the grid with cancellation of a GO. Some consumers consider green power based on GO as insufficient because GO do not necessarily represent power from new and additional renewable energy installations. Therefore, a range of quality seals for green power have emerged in Germany, which in addition to physical delivery and a certification of origin also contain an additional benefit, such as the regional origin, or newly installed renewable energy capacity. Thus, such tariffs use certificates in a way that more actively promotes the energy transition and renewable energy capacity additions.[25]

How might GOs become more important in the EU energy transition?

While GO so far have not played a significant role in renewable energy expansion in the EU, this may change as market driven expansion of renewables gains in relevance and countries phase out subsidy schemes, while renewable expansion targets become even more ambitious. At the same time, tightening climate goals will cause more consumers to procure low-carbon power. Green Power Purchasing Agreements are one instrument that may see increasingly wide application with more market driven expansion of renewable energy. The producers and consumers in a virtual PPA can be geographically far apart, so PPAs in many cases do not contain direct physical delivery from the producer to the consumer. Rather, power is physically sourced from the wholesale market, while the transaction between the power producer and consumer is based on GOs getting canceled and the price agreed in the PPA being paid, often with intermediaries involved. For such a virtual PPA, GO or comparable certificates are necessary to depict the electricity’s green property in the transaction, along with other characteristics desired by the buyer.[26]

Combining GO and Green PPAs could provide revenue for old installations with expired subsidies and can provide additional revenue for new projects and thereby facilitate financing. PPAs already play an important role in financing new PV installations in UK, Italy, Spain, and Portugal. In Spain, power from 4 GW of PV installations has been fed into the grid based on PPAs, without other subsidies. Green PPA including GOs are likely to become more relevant in Germany as EEG support diminishes and market-driven renewable energy expansion gains importance. Even now, this is relevant for old installations where EEG supports are set to expire—a process that began in January 2021—and for new installations that either opted out of EEG tenders or bid into tenders at a price of zero, thus not receiving any subsidies. The emerging EU Green Taxonomy and corporate commitments should further add to the expected demand for certified green electricity. As they can mitigate price risks, Green PPAs also can be a response to the cannibalization effect that occurs among RE producers when supply is higher than demand and causes prices to plummet.[27]

Green PPAs might soon pick up their pace in Europe because the EU Commission seeks to promote green PPAs in more member states. Therefore, it outlined three options for promoting PPAs in its proposal for an amendment of the EU Renewable Energy Directive (RED) that it released as part of its Fit for 55 Package on 14 July 2021. The package is a hallmark update to the EU climate and energy policy to reflect the new climate targets of cutting emissions by 55% from 1990 levels by 2030. The three options are:

- Additional guidance to member states on how to strengthen PPAs

- Financial support for use of PPAs by small and medium-sized enterprises

- Strengthening regulatory measures on PPAs, placing burden on member states to remove undue barriers but creating more certainty for producers and consumers of renewable power. The document proposes that national governments should grant all requests for issuance of GO, including installations receiving other forms of support. This may upend the current practice in Germany.

The proposal states a preference to furthering the first two options. The proposal will still be subject to discussions and negotiations under the EU’s legislative process and the content of the final RED may differ significantly from the proposal.[28]

Conclusion

Green certificates (RECs in North America and GOs in Europe) serve policy goals beyond merely achieving official government targets, and enable participation of the public and corporations in the energy transition. As consumer awareness rises and government targets become stricter, these markets have evolved with time, and will certainly continue to change and grow.

In the U.S., criticism of RECs as a form of greenwashing has pushed more buyers towards PPAs and led to the development of 24/7 time-matched RECs, to enable companies to show they are offsetting power consumption in real time. REC tracking is becoming more sophisticated, and starting to incorporate information on instantaneous fuel mix, employment, and physical location—all to meet the demand of the market and encourage REC sales.

In Europe, countries are also taking further action to bolster voluntary purchases of renewable energy. Requiring large consumers to disclose the origin of renewables using certificates can bolster demand and increase confidence in the value of certificates.

Green certificates can support new RE capacity additions better if they include additional properties going beyond the mere green properties—such as regional or time-based information. Ideally green certificates should be complementary to other policies and have additional supportive value.

[i] The RE100 is a global community of businesses committed to 100% renewable electricity.

[1] “REC Questions & Answers,” Environmental Tracking Network North America, 2018, at https://resource-solutions.org/wp-content/uploads/2018/01/ETNNA-REC-QandA.pdf.

[2] “Renewable Portfolio Standards and Clean Energy Standards,” DSIRE, N.C. Clean Energy Technology Center, North Carolina State University, April 2020, at https://ncsolarcen-prod.s3.amazonaws.com/wp-content/uploads/2020/09/RPS-CES-Sept2020.pdf.

[3] “REC Questions & Answers,” Environmental Tracking Network North America, 2018, at https://resource-solutions.org/wp-content/uploads/2018/01/ETNNA-REC-QandA.pdf.

[4] Jenny Heeter and Eric O’Shaughnessy, “Status and Trends in the Voluntary Market (2019 data),” National Renewable Energy Laboratory, presentation at the Renewable Energy Markets Conference, 23 September 2020, at https://www.nrel.gov/docs/fy21osti/77915.pdf.

[5] Jenny Heeter and Eric O’Shaughnessy, “Status and Trends in the Voluntary Market (2019 data),” National Renewable Energy Laboratory, presentation at the Renewable Energy Markets Conference, 23 September 2020, at https://www.nrel.gov/docs/fy21osti/77915.pdf.

[6] Eric O’Shaughnessy et al., “Status and Trends in the U.S. Voluntary Green Power Market (2016 Data),” National Renewable Energy Laboratory, NREL/TP-6A20-70174, October 2017, at https://www.nrel.gov/docs/fy17osti/67147.pdf.

[7] “Voluntary Green Power Procurement,” National Renewable Energy Laboratory, 2021, at https://data.nrel.gov/submissions/151

[8] Jenny Heeter and Eric O’Shaughnessy, “Status and Trends in the Voluntary Market (2019 data),” National Renewable Energy Laboratory, presentation at the Renewable Energy Markets Conference, 23 September 2020, at https://www.nrel.gov/docs/fy21osti/77915.pdf.

[9] “REC Questions & Answers,” Environmental Tracking Network North America, 2018, at https://resource-solutions.org/wp-content/uploads/2018/01/ETNNA-REC-QandA.pdf.

[10] Sarah Golden, “The latest trends in renewable energy procurement,” Greenbiz, 17 May 2021, at https://www.greenbiz.com/article/latest-trends-renewable-energy-procurement.

[11] Ben Gerber, “A Path to Supporting Data-Driven Renewable Energy Markets,” M-RETS (Midwest Renewable Energy Tracking System), March 2021, at https://www.mrets.org/wp-content/uploads/2021/02/A-Path-to-Supporting-Data-Driven-Renewable-Energy-Markets-March-2021.pdf.

[12] Gregory Miller, “Beyond 100 % renewable: Policy and practical pathways to 24/7 renewable energy procurement,” The Electricity Journal, March 2020, https://doi.org/10.1016/j.tej.2019.106695

[13] Jacques A. de Chalendar and Sally M. Benson, “Why 100% Renewable Energy Is Not Enough,” Joule 3, 19 June 2019, at https://doi.org/10.1016/j.joule.2019.05.002.

[14] Alberto Pototschnig and Ilaria Conti, “Upgrading Guarantees of Origin to Promote the Achievement of the EU Renewable Energy Target at Least Cost”, Robert Schuman Centre for Advanced Studies, Research Report, RSCAS/Florence School of Regulation, 26 January 2021, at https://cadmus.eui.eu/bitstream/handle/1814/69776/QM-03-21-034-EN-N.pdf?sequence=3

[15] “AIB”, Association of Issuing Bodies, accessed on 28 June 2021 at https://www.aib-net.org/aib

[16] Yan Qin, “European GO market: overview and latest trend”, presentation, Refinitiv, 21 June 2021

[17] “Share of renewable energy in the EU up to 19.7% in 2019”, European Commission, 18 December 2020, at https://ec.europa.eu/info/news/share-renewable-energy-eu-2020-dec-18_en

[18] “EU Power Sector in 2020 – Landmark moment as EU renewables overtake fossil fuels”, Ember Climate, accessed on 1 July 2021 at https://ember-climate.org/project/eu-power-sector-2020/

[19] Yan Qin, “European GO market: overview and latest trend”, presentation, Refinitiv, 21 June 2021

[20] “Industry calls for domestic guarantees-of-origin power policies”, Independent Commodity Information Services, 18 February 2021, at https://www.icis.com/explore/resources/news/2021/02/18/10607745/industry-calls-for-domestic-guarantees-of-origin-power-policies

[21] Tom Lindberg, “Record European demand for renewable energy in the first half of 2020 – despite COVID-19,” ECOHZ, 8 October 2020, at https://www.ecohz.com/press-releases/record-european-demand-for-renewable-energy-in-the-first-half-of-2020-despite-covid-19/

[22] “Refinitiv deepens climate change action amid COVID-19,” REFINITIV, 21 April 2020, at https://www.refinitiv.com/en/media-center/press-releases/2020/april/refinitiv-deepens-climate-change-action-amid-covid19

[23] “Industry calls for domestic guarantees-of-origin power policies”, Independent Commodity Information Services, 18 February 2021, at https://www.icis.com/explore/resources/news/2021/02/18/10607745/industry-calls-for-domestic-guarantees-of-origin-power-policies

[24] “3 Fragen an Aurora Energy Research – Günther: “Herkunftsnachweise können Zubau der Erneuerbaren Fördern””, Energate Messenger, 10 January 2020, at https://www.energate-messenger.de/news/199409/guenther-herkunftsnachweise-koennen-zubau-der-erneuerbaren-foerdern-

[25] “Was ist Ökostrom?“, NextKraftwerke, accessed on 1 July 2021 at https://www.next-kraftwerke.de/wissen/oekostrom

[26] Dr. Ruth Brand-Schock, Natalie Lob “Positionspapier Finanzierung und Marktintegration

von Erneuerbare-Energien-Anlagen”, Bundesverband der Energie- und Wasserwirtschaft (BDEW), 5 March 2021, at https://www.bdew.de/service/stellungnahmen/bdew-positionspapier-zur-finanzierung-und-marktintegration-von-erneuerbare-energien-anlagen/

[27] Dr. Ruth Brand-Schock, Natalie Lob “Positionspapier Finanzierung und Marktintegration von Erneuerbare-Energien-Anlagen”, Bundesverband der Energie- und Wasserwirtschaft (BDEW), 5 March 2021, at https://www.bdew.de/service/stellungnahmen/bdew-positionspapier-zur-finanzierung-und-marktintegration-von-erneuerbare-energien-anlagen/

[28] “EC wants to national push on long-term renewable PPAs – draft”, Montel News, 7 July 2021, at https: https://www.montelnews.com/news/1233494/ec-wants-national-push-on-long-term-renewable-ppas–draft