Introduction

During the Executive Meeting of the State Council[1] on 31 March 2020, the Chinese government has decided to extend the current purchasing subsidies and NEV purchase tax exemptions in order to stimulate vehicle consumption in China[2]. This came at a time, when the Chinese (and international) automotive industry is under immense pressure of downturn of production and sales due to the COVID-19 pandemic, in particular in the NEV industry.

This article sheds light on the recent changes of the Chinese incentive policies for NEVs. The article gives an overview of the current market developments and the impact of the pandemic on the automotive and NEV industry in China, the measures taken by the Chinese government in order to stimulate car consumption.

Pre-COVID-19: NEV incentive policies

Against the background of energy security, electro-mobility is an important element of the Chinese government’s roadmap to promote climate-friendly and sustainable transport. China’s central government and local authorities in recent years have launched various support policies to push market development, foster the establishment of advanced industry chains, develop a skilled labour force and to generally achieve technological breakthroughs and efficiency gains in the development and application of NEV technologies.

NEV sales in China took off after years of provision of purchase subsidies and other preferential policies. The long-standing incentive policies fuelled China’s electric-vehicle boom but also caused market distortion. In order to promote the transformation of the NEV industry from a policy-driven towards a market-oriented development, the Chinese government in 2015 and 2017 introduced policies[3] for a step-by-step reduction of subsides aiming at a total subsidy phase-out by the end of 2020. Based on those policies, on 26 March 2019 the Chinese government issued the Notice on Further Improving the Promotion and Application of Financial Subsidy Policies for NEVs.[4] According to the Ministry of Finance (MoF)[5], NEV subsidies in 2019 would be reduced by 50% on average standard of 2018, and would be phased out by the end of 2020.

In order to specifically promote the electrification of public transport and Fuel Cell Vehicles (FCVs), the Notice on Further Improving the Promotion and Application of Financial Subsidy Policies for NEVs emphasized that specific incentive polices for New Energy Buses and FCVs would be announced later separately[6]. In May 2019, MoF issued the Notice on Supporting the Promotion and Application of New Energy Buses[7], which clarified the details for the provision of national NEV purchasing subsidies[8], awards provided by financial authorities for the operation of New Energy Busses, and local incentive policies for the promotion of New Energy Buses. According to the policy from 23 April 2020[9], FCVs will be further promoted by providing awards for cities adopting FCVs.

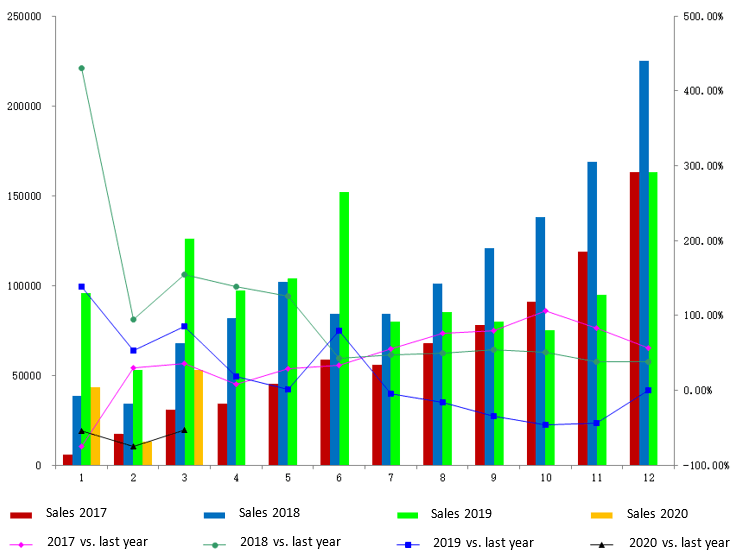

The subsidy policies have significant impact on the development of the NEV market and respective production and sales figures. According to the China Association of Automobile Manufacturers (CAAM), the cumulative production and sales of NEVs in 2019 were 1.242 million and 1.206 million vehicles, respectively, a year-on-year decline of 2.3% and 4.0%[10]. Figure 1 shows that after the announcement of the phase-out of NEV subsidies in March 2019, the NEV Industry experienced a decline in sales.[11]

Impact of the COVID-19 pandemic to the NEV industry in China

The outbreak of COVID-19 is posing severe challenges to China’s and the world’s economy and sales, production, R&D and logistics of the automotive industry. According to CAAM, in February 2020, production and sales figures experienced a sharp decline due to the impact of COVID-19 on vehicle production and demand.

Measures to stimulate NEV demand

In order to strengthen economic development, to support a resumption of production and to secure employment in the NEV industry, the Chinese government has announced the following measures: to stimulate demand for NEV and to promote and boost the automotive industry in China, the Executive Meeting of the State Council on March 31, 2020, determined that NEVs would continue to be exempt from the 10 per cent vehicle purchase tax through the end of 2022. In addition, it was determined during the meeting that the NEV purchase subsidy policy, which before was set to expire on 31 December 2020, would be extended for another two years until the end of 2022.[14] On 23 April 2020, the details of the NEV purchase subsidy extension have been released[15], overall subsidies will be gradually reduced by 10%, 20% and 30% year-over-year for 2020, 2021, 2022, respectively. Before April 23, 2020, customers could receive subsidies of RMB 18,000 (EUR 2,360) for purchasing NEVs with a range between 250 and 400 kilometers and RMB 25,000 (EUR 3,270) for purchasing NEVs with a range of more than 400 kilometers. After a transition period of the new policy from 23 April to 22 July 2020[16], customers can receive subsidies of RMB 16,200 (EUR 2,108) for purchasing NEVs with a range between 300 to 400 kilometers and RMB 22,500 (EUR 2,928) for purchasing NEVs with a range over 400 kilometers. The subsidies can only be granted for vehicles produced with a list price of up to RMB 300,000 (EUR 38,600), with the only exception for NEVs with replaceable batteries. This indicates that battery swap systems as well as respective technological and business models as part of a diversified NEV industry are specifically promoted by the Chinese government. FCVs will be further promoted according to the policy from 23 April, by providing awards for cities adopting FCVs.

Conclusion

During the Advisory Committee Meeting for the New Energy Vehicle Industry Development Plan (2021-2035), Mr. Xin Guobin, Deputy Director-General (DDG) of Ministry of Industry and Information Technology (MIIT) pointed out that China’s NEV industry is currently in a critical period, superimposed by the impact of the COVID-19 epidemic and global oil price dynamics, with the downward market pressure increasing. But regardless of the COVID-19 pandemic, 2020 is a special year for NEV policy in China and the decision to extend the NEV purchasing subsidies did not come as a full surprise. The schedule for the phase-out and specific conditions for follow-up policies were already discussed intensely after the issuing of the Further Improving the Promotion and Application of Financial Subsidy Policies for NEVs.

The question remains how the extension of subsidies will impact the NEV industry and overall market development in the short, medium and long term, and which environmental and climate related impacts the policy changes will have. According to a survey of the German VDA (German Association of the Automotive Industry), the COVID-19 pandemic severely impacts the OEMs’ production and sales in short-term. This has also impacted on the ability and ambition of implementing stricter environmental standards – “All these challenges make it harder for OEMs to fulfill the national emission requirement”[17]. On April 30, 2020, the date to enforce the CHINA 6 emission standard for light-duty vehicles has been extended from the originally scheduled date of 1 July 2020 to 1 January 2021[18]. On the consumer side, if the price of gasoline continues to stay low, it will be harder for the NEV industry to compete with conventional diesel and petrol vehicles. This is not only detrimental to the NEV industry, but also detrimental to ambitious environmental and climate policies and ambitions.

In the short term, the decision of the State Council Executive Meeting can be understood as a stabilization of the automotive industry in the face of the COVID-19 outbreak and the related market downturn. The decision can also be understood as a strong signal to OEMs and consumers and a reinforcement of the commitment from the central government to further support the promotion of NEVs. In the medium to long run (at least until the end of 2022), it can be expected that the Chinese government will further stabilize and promote the NEV industry by continuously adjusting the respective policies, also in order to reduce market distortion. In addition, besides the further adjustment of fiscal NEV support policies, a broad range of non-fiscal support measures is needed to ensure a long-term sustainable NEV market development. This includes higher vehicle emission standards, license plate and admission restrictions for conventional vehicles as well the further integrated development and construction of respective charging infrastructure.

[1] The executive meeting of the State Council is one of the current statutory meetings of the State Council of the People’s Republic of China. It consists of the Prime Minister, the Deputy Prime Minister, the State Councilor, and the Secretary General of the State Council. Content of the executive meeting is discussion and decision making on major issues in the work of the State Council. The meeting is generally held once a week. Representatives from relevant departments can be invited to attend the executive meetings.

[2] http://www.gov.cn/premier/2020-03/31/content_5497614.htm

[3] Notice on the Promotion and Application of Financial Support Policies for New Energy Vehicles 2016-2020, 29 April 2015, http://www.miit.gov.cn/n1146285/n1146352/n3054355/n3057585/n3057590/c3617158/content.html ; Notice on adjusting the policy of financial subsidies for new energy vehicles subsidies, 16 January 2017, http://www.most.gov.cn/tztg/201701/t20170116_130495.htm

[4] Notice on Further Improving the Promotion and Application of Financial Subsidy Policies for New Energy Vehicles, http://jjs.mof.gov.cn/zhengwuxinxi/zhengcefagui/201903/t20190326_3204190.html

[5] http://www.mof.gov.cn/zhengwuxinxi/caijingshidian/xinhuanet/201903/t20190327_3204495.htm

[6] http://jjs.mof.gov.cn/zhengwuxinxi/tongzhigonggao/201903/t20190326_3204238.html

[7] Notice on Supporting the Promotion and Application of New Energy Buses, http://www.mof.gov.cn/mofhome/jinjijianshesi/zhengwuxinxi/zhengcefagui/201905/t20190508_3251282.html

[8] Technical indicators and phase-out transition period of the New Energy Bus incentive policies refer to Notice on Further Improving the Promotion and Application of Financial Subsidy Policies for New Energy Vehicles on 26 March 2019.

[9] Notice on improving the promotion and application of financial subsidy policies for NEVs http://www.gov.cn/zhengce/zhengceku/2020-04/23/content_5505502.htm, MoF, April 23, 2020

[10] Economic Operation of the Automotive Industry in 2019, 13 January 2020, CAAM, http://www.caam.org.cn/search/con_5228367.html

[11] Since the policy implementation transition period (from the issuing of the policy on March 26, 2019 to June 25, 2019), the decline of sales started after June 2019 (see Notice on Further Improving the Promotion and Application of Financial Subsidy Policies for New Energy Vehicles, http://jjs.mof.gov.cn/zhengwuxinxi/zhengcefagui/201903/t20190326_3204190.html)

[12] http://www.miit.gov.cn/n1146312/n1146904/n1648362/n1648363/c7861654/content.html

[13] http://www.caam.org.cn/chn/4/cate_39/con_5229112.html

[14] http://www.gov.cn/xinwen/2020-03/31/content_5497614.htm

[15] Notice on improving the promotion and application of financial subsidy policies for NEVs http://www.gov.cn/zhengce/zhengceku/2020-04/23/content_5505502.htm, MoF, April 23, 2020

[16] Vehicles not meeting the 2020 requirement will be entitled to a 50% discount of the 2019 subsidy during the transition period, and those meeting the 2020 requirement will get the full subsidy.

[17] Recommendation on extending the transition period of China VI Particle Number requirement, VDA China, Feb. 12, 2020

[18] Notice on measures to stabilize and expand automobile consumption, April 30, 2020 https://www.ndrc.gov.cn/xxgk/zcfb/tz/202004/t20200430_1227367.html