Authors: Chenzi Yiyang (GIZ) and Vincent Fremery (GIZ)

Study on Technical System of the Life Cycle of Battery Electric Buses

Against the backdrop of the 2030 carbon dioxide emission peaking and 2060 carbon neutrality goals proclaimed by Chinese President Xi Jinping, China’s “14th Five Year Plan for a Modern and Comprehensive Transportation System (2021-2025)” was published on January 18th, 2022. The plan highlights the development principle of green transition, people-oriented development, and innovation. It also confirms the significant role of New Energy Buses (NEB) in China’s strategy to carbon emission reduction in cities. As one of the indicators for “Green & Innovative Mobility”, 72% of China’s urban public buses are expected to be electric by 2025.

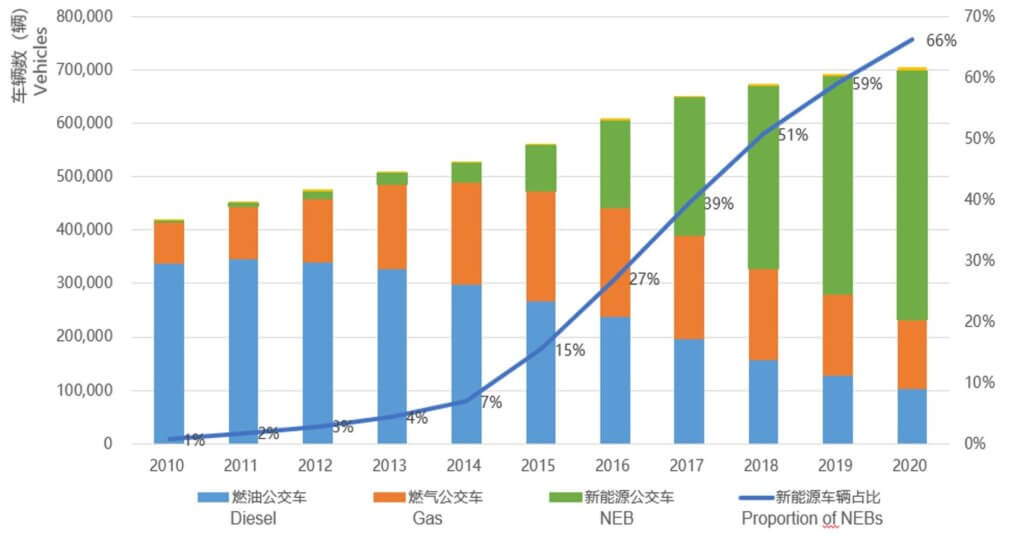

In the past decade, China has made remarkable progress in the promotion of NEBs. By the end of the year 2020, there were around 466,000 NEBs in China, of which 378,700 buses are Battery Electric Buses, accounting for 66% and 53.8% of the total amount of buses, respectively[1]. A number of cities, Shenzhen, Tianjin, Zhengzhou, just to name a few, have achieve 100% of bus fleet electrification. But challenges still exist. During the period of rapid vehicle electrification, issues such as lacking capacities for effective BEB system integration and procurement strategies, low operating efficiency, unreasonable layout planning of supporting and charging infrastructure facilities, and poor maintenance and service levels, are faced by many cities.

Source: China Academy of Transportation Sciences (CATS) of the Ministry of Transport of the People’s Republic of China (MoT)

With the aim to support China on the decarbonization of its transport system by further promoting and improving BEB efficiency, safety, cost-effectiveness, energy saving, and emission reduction impact, the Sino-German Cooperation on Low Carbon Transport (CLCT) project of the Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) GmbH and the China Academy of Transportation Sciences (CATS) of the Ministry of Transport of the People’s Republic of China (MoT) conducted the “Study on Technical System of the Life Cycle of Battery Electric Buses” from 2020 to 2021.

The study follows the life cycle stations of battery electric buses, from its procurement, charging, operation, maintenance, to the decommissioning of batteries. It provides a technical guide for stakeholders in each of the procedures to achieve safety, efficiency, and sustainability. As part of the study, eight case cities covering various geographic area and social-economic level were identified: Zhengzhou, Chengdu, Shenzhen, Jinan, Guangzhou, Shenyang, Yinchuan, and Xi’an. Through surveys and interviews, the study collected first-hand data on the challenges, solutions, and best practices in these cities. Based on literature review, comparative analyses, field study, and expert consultations, the study then provides recommendations for all relevant stakeholders.

Technical System of Battery Electric Buses in China Workshop

Upon the completion of the study, the “Technical System of Battery Electric Buses in China Workshop” was held on January 21, 2022. Industry representatives, including Chinese e-bus manufactures, operators, charging service providers, national bus quality supervision centers, and industrial associations, shared the latest developments in their respective fields. International representatives from the Berlin Transport Company (BVG) and the International Association of Public Transport (UITP) presented Berlin’s large-scale e-bus procurement initiative and an international bus operator’s perspective on NEB. Representatives from GIZ’s global offices, World Bank, International Council on Clean Transportation (ICCT), Innovation Center for Energy and Transport, PwC, and academia participated in the workshop.

Performance of BEBs have been steadily improving and became first choices for most cities

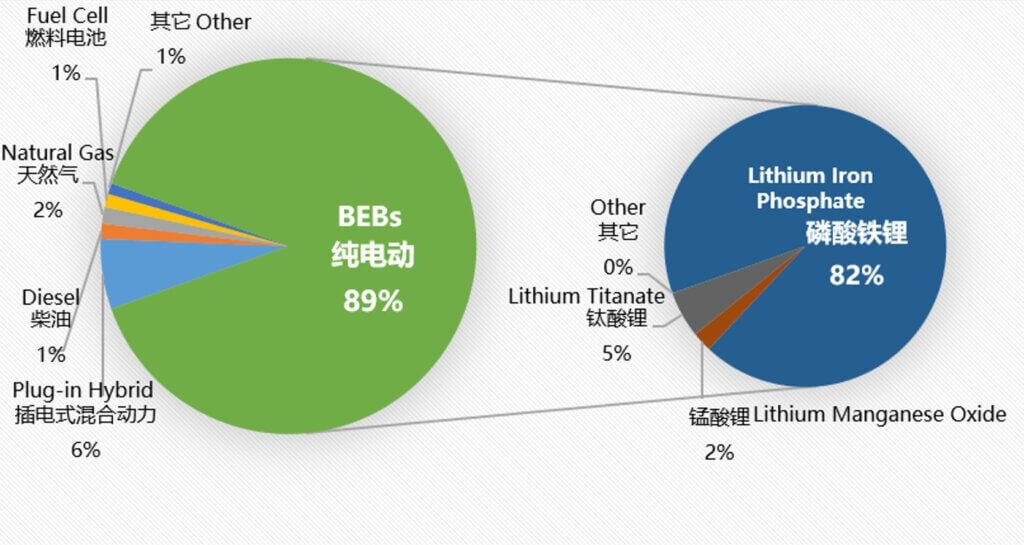

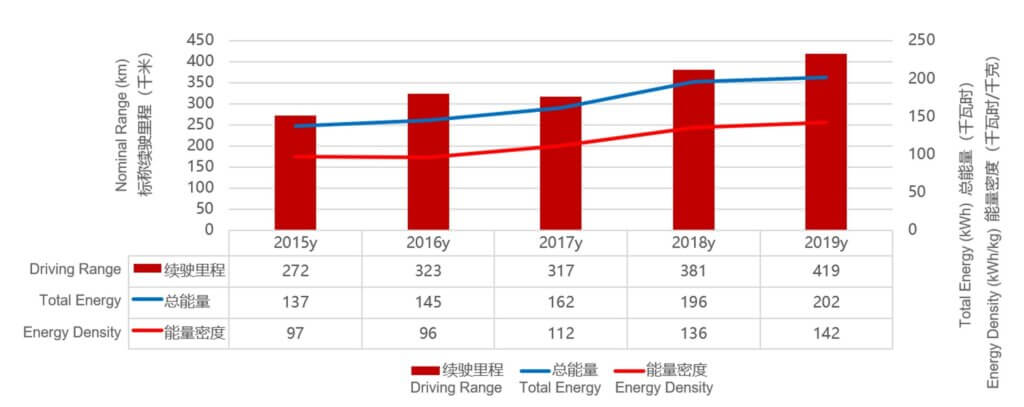

By 2019, BEBs accounted for 89% of newly procured buses, whereby lithium iron phosphate batteries dominate (Figure 2). The performance of BEBs has steadily improved from 2015 to 2019 in terms of nominal range, battery capacity, and battery energy density. In 2019, these three performance indicators increased by more than 47% compared to 2015.

Data Source: CATS, MOT

Data Source: CATS, MOT

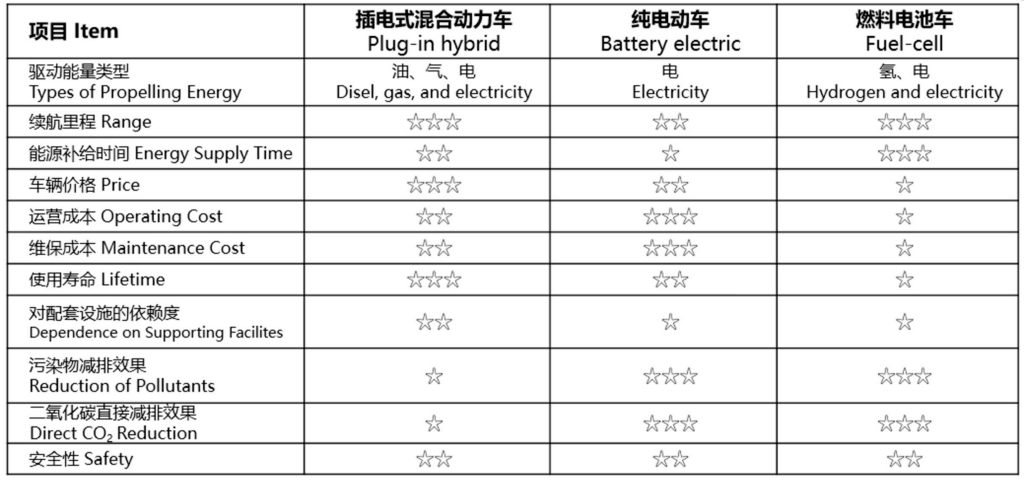

Given the high emissions and pollutant reduction potential, as well as operation and maintenance cost advantages, BEBs are the first choice for most Chinese cities – a trend that is likely to continue in the future. Only for cities with cold weather, severe climate, and limited resources for the construction of charging infrastructure, plug-in hybrid buses constitute an option (Figure 4).

Source: CATS, MOT

Mr. LIANG Fengshou, Senior Engineer from BYD, the biggest E-Bus manufacture in China, mentioned during the workshop that the battery capacity will continue to increase and lead to major breakthrough within the next five years while the motor and electronic control technology will improve on their energy efficiency. The gravimetric energy density for the Lithium Iron Phosphate Batteries (LFP) will increase from the 140 Wh/kg (the 2014 level) to 180 Wh/kg in year 2022. Within the next five years, LFPs could be replaced by solid-state batteries which can reach gravimetric energy density of 350-450 Wh/kg.

Charging Infrastructure: No Golden Bus-Charging Pole Ratio

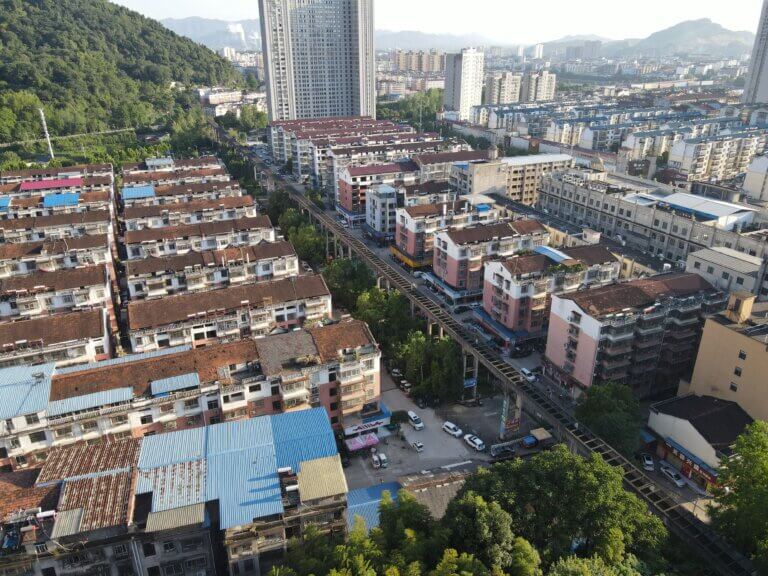

Charging infrastructure is one of the main constraints for the deployment of NEBs in China. Critical aspects such as insufficient and uneven distribution of charging poles, high upfront investments and long payback periods as well as the technical performance level constitute the existing bottleneck. To address the problem of limited charging poles, cities are adopting different solutions. In Tianjin, commercial areas in the city center undergone re-design processes in land-use model to make full use of all spaces available to install charging facilities. To tackle the same issue of insufficient land resources for charging infrastructure in the cities, Jinan and Zhengzhou built charging facilities using the spaces under elevated overpass bridges. For fast-charging solutions which require less land surface, such as in the city of Chengdu, charging stations are placed along roadside parking spaces in combination with high-capacity automatic charging arch systems (Figure 5).

Source: CATS, MOT

There is no golden rule for the best bus-charging pole ratio. The required amount of charging facilities depends on the charging type, battery type, and charging strategy. Among the case cities that adopt slow charging, the bus-charging pole ratio is 2:1 in Zhengzhou and 3:1 in Tianjin, Jinan, Yinchuan, and Xi’an. In Shenzhen, where the operation management was recently optimized, the ratio is 4:1.

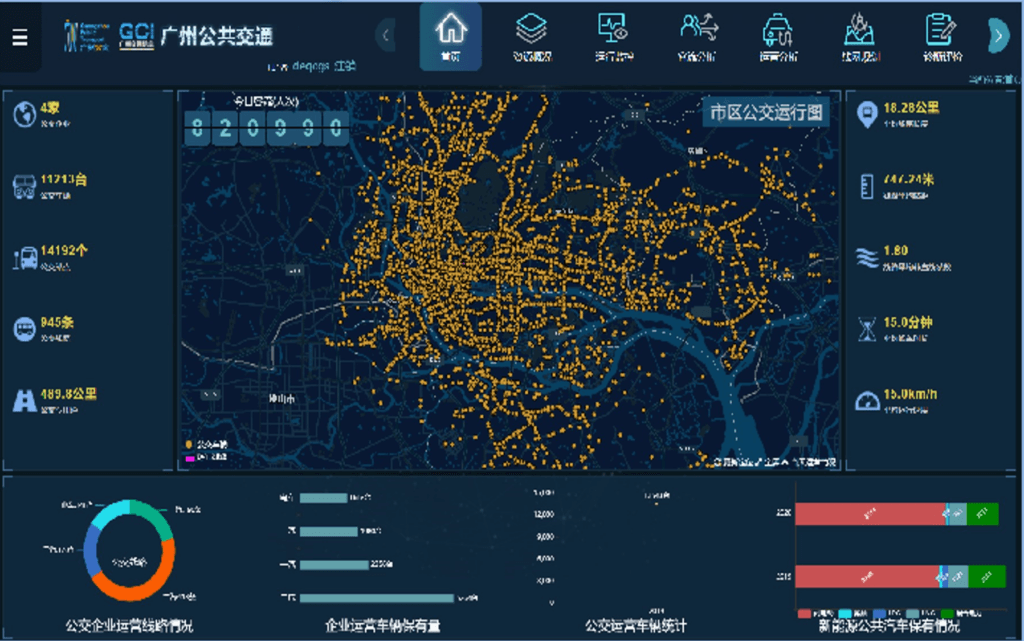

Operation & Management: From Fleet Electrification to Refined Management

During the workshop, Mr. ZHANG Zhigang from the Guangzhou Public Transport Group shared the experience of adopting a smart scheduling system. The system builds multiple algorithms for passenger flow prediction, using a mix of satellite data, public transport IC card data, and video data (Figure 6). The real-time data and prediction ensure 95% accuracy on passenger flow prediction. During the one-year application, over 90% of bus scheduling was generated by the system. The system also saved over 10% of staff costs and increased the passenger volume by 10%.

Source: Guangzhou Public Transport Company

Guangzhou also adopted a cloud-based energy analysis system. The system collects detailed operational data of the start/end station, operational mileage, tasks for all drivers, etc. for each bus line and automatically calculates the daily energy consumption data based on bus and driver. At the same time, other automated systems were installed to centrally monitor the AC temperature, battery temperature, engine parts, etc. of the buses.

Future trends for NEB development

Accelerated by China’s targets to reach carbon dioxide emission peaking before 2030 and carbon neutrality before 2060, and the increasing pressure to decarbonize transport, the application of battery electric buses will continue to grow at a steady pace in the coming years. Also, with the overall improvements on bus service, especially the development of on-demand buses, more and more smaller buses under eight meters will appear. With the phasing out of NEB subsidies, the cost advantage of BEB will gradually disappear, which could lead to higher procurement of plug-in hybrid buses. The number of hydrogen fuel cell-electric buses could also increase with the promotion of hydrogen pilot cities but should be seen very critical due to high costs, related energy efficiency issues and the source of hydrogen. Last but not least, the technological innovation of vehicle electrification goes hand in hand with the uptake of Intelligent Connected Vehicles (ICV). Automated BEBs are already under piloting and will certainly scale up.

Policy Recommendation: refined operation + national battery recycling strategy

With the existing basis of bus-fleet electrification and the phasing out of NEB subsidies, priorities should be given to the operation stage. To improve the overall management capacity and to take advantage of the data provided by NEBs, a national level NEB supervision and management platform could enable the governance of the actual operation. Based on the operational data, targeted national level guidelines by-laws can be issued. Targeted subsidies and evaluation measures that relate to the daily operation of NEBs should be adopted. For example, the frequency of usage of NEBs and the passenger volume can be listed as indicator for performance evaluation. To improve the profit-margin of privately operated charging infrastructure, operational subsidies could also be provided. In the next stage, to avoid the separated development of NEB promotion and support facility development, cities should come up with systematic medium- and long-term planning (side info: GIZ supported the city of Tianjin on NEB-based bus network optimizationv). Feasible electrification plans should be designed under the policy umbrella of achieving carbon dioxide peaking and carbon neutrality in coordination with local carbon emission reduction goals, local industry development level, energy-mix, and features of the public transport system.

The battery decommissioning and recycling is another key topic for national-level policy makers. To reflect the climate-and-environment friendliness of NEBs, recycling systems, channels, and standards are urgently needed. During the workshop, Mr. YE Dongqiang from the China Road Transport Association pointed out that there will be over 100,000 ton of decommissioned batteries every year from now on. With comprehensive recycling measures, 90% of these materials can be reused. To achieve that, Mr. YE suggested to approach policy-makers from three aspects:

- Promote new technologies (such as battery pre-treatment and battery echelon use) that slows down the battery exhaustion and adopt the “recovery + pre-treatment + echelon use + recycling” model.

- Improve the tracing system of batteries to monitor battery usage information in its life cycle

- In combination with the carbon trading mechanism, to promote the label and certification of recycled material for the production of new batteries

Strengthen exchanges & cooperation

The coordination among policy-making, NEB production, technology innovation, and application is vital for the long-term development of the NEB industry. Industrial platforms that gather these stakeholders, such as the E-Bus Performance Assessment Competition (EB-PAC),providechannels for showcasing the most advantageous technology, but also provide communication mechanism between the demand and supply sides. Such platforms should be strengthened and incorporate the energy industry.

Combating climate change and promoting the green and low carbon transformation of the transport sector is challenging for all. China’s ambition to promote green and low carbon transport, and the set transport decarbonization goals of the European Union (EU) and the new German government are a good platform for sharing knowledge, expertise and lessons-learned in order to jointly drive the needed green transition.

In the next stage, GIZ and CATS will continue to engage on this topic and further disseminate the research findings. The downloadable full report will soon be made available.

The Sino-German Cooperation on Low Carbon Transport (CLCT) project is implemented by GIZ on behalf of the Federal Ministry for the Environment, Nature Conservation, Nuclear Safety and Consumer Protection (BMUV). The project is implemented in partnership with China’s MoT.

[1] Data Source: China Academy of Transportation Sciences (CATS) of the Ministry of Transport of the People’s Republic of China (MoT).