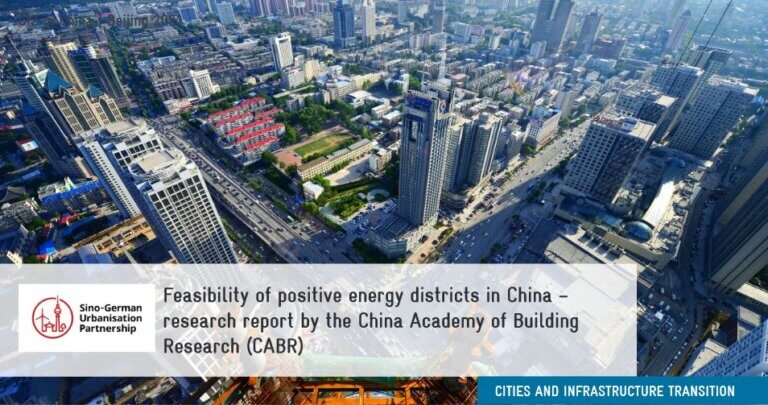

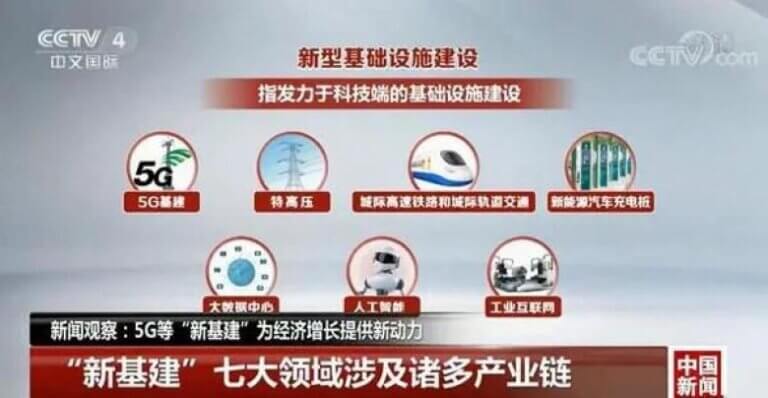

New stimulus package after the Covid-19

What is the new package? On March 4, the Standing Committee of the Political Bureau of the Communist Party of China (CPC) decided to speed up the construction of major infrastructure projects. As the new stimulus package, it focuses on technologies that promote sustainable infrastructure.