Globally, the transport and mobility sector is undergoing a holistic transformation, due to technological innovation, new business models, changing customer demands and political pressure to tackle environmental challenges. One possibly very sustainable development has been the growth of ride- and car-sharing services within the last years.

This article provides an overview of the current dynamics of China`s car-sharing market, focusing on B2C business models and on providing an outlook on what the future of mobility may look like.

The need for shared mobility in China is high

In China, car ownership rate is still very low, e.g. when compared to Germany. In early 2016, the car density in Germany was 552 passenger cars per 1,000 inhabitants, which means that a total of 45.7 million cars rolled on Germany`s roads. In comparison, Chinese roads carried about 163.1 million passenger cars in the same year, which equals a car density of 118 cars per 1,000 capita (see Figure 1). Although car density in China was only about a fifth of that in Germany, it does not mean that Chinese roads were not jammed. According to the 2017 Tom Tom Traffic Index, 10 of the 25 most congested cities in the world were in mainland China: Chongqing, Chengdu, Beijing, Changsha, Guangzhou, Shenzhen, Hangzhou, Shijiazhuang, Shanghai and Tianjin.

If China would reach the car density of Germany, another 760 million cars would be on the streets, almost 17 times the existing car stock of Germany. Of course, significant differences regarding the specific domestic conditions but also uncertainties with Chinese consumers’ willingness to own a car are leading to different assumptions of future vehicle stock development in China. But even if “just” another 300 million cars would hit traffic, this would potentially lead to a significant increase of greenhouse gas, local air pollutant and noise emissions, congestion and reduced urban life quality.

In order to avoid a collapse of the infrastructure system by potentially adding hundreds of millions of cars to Chinese roads, the Chinese government promotes the development of a low carbon and “green” transport sector. This includes the massive expansion of public transport infrastructure, the boost of intelligent mobility systems and a focus on CASE (Connected-Autonomous-Shared-Electric). In particular shared mobility is a key to ensure more sustainable transportation systems.

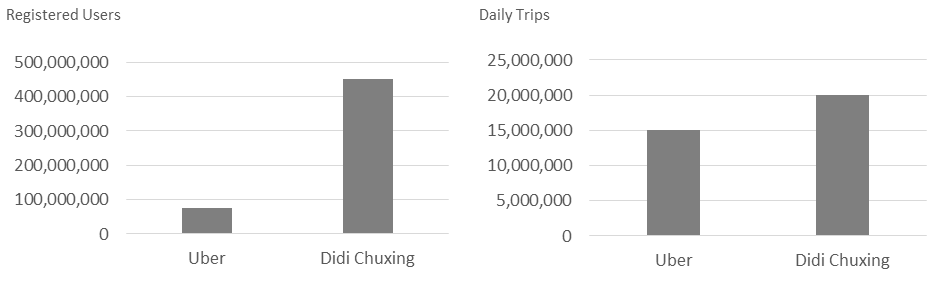

And indeed: over the past years China has become a trailblazer in new mobility services, such as car-sharing, bike-sharing and ride-hailing. While most people in Europe and the US have heard about Uber and Car2Go, only a few people outside of China heard of Didi Chuxing or GoFun. In fact, however, Didi Chuxing, China`s version of Uber (Didi acquired Uber China in 2016), has about 6 times more users than Uber: By end of 2017, Didi boasts 450m registered users in China, taking about 20m trips daily and has a valuation of EUR 41bn. In comparison, Uber has 75m registered users worldwide, taking about 15m trips daily and is valuated at EUR 52bn (see Figure 2).

Compared to ride-hailing, the car-sharing market in China is still very small. But this could change in the near future.

The current status quo of car-sharing in China

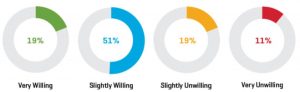

Even if China`s car market is yet not even close to being saturated and will further grow, there are changes in the customer`s perception of the car as a status symbol and an increasing willingness to consider alternative mobility solutions. A recent JD Power survey of consumer satisfaction states that about 19 percent of consumers in China are “very willing” and 51 percent are “slightly willing”, to consider alternative mobility solutions to owning a car, such as car-sharing (see Figure 3). According to JD Power, a similar survey in the US showed that 69 percent of people still want to own their vehicles.

To understand the current development trends better, let`s see how car-sharing in China started and what the market looks like today.

The very first player in the car-sharing game in China was CC Clubs (车纷享). The company was founded in 2010 and started to provide mobility services with a small fleet for the Alibaba business campus.

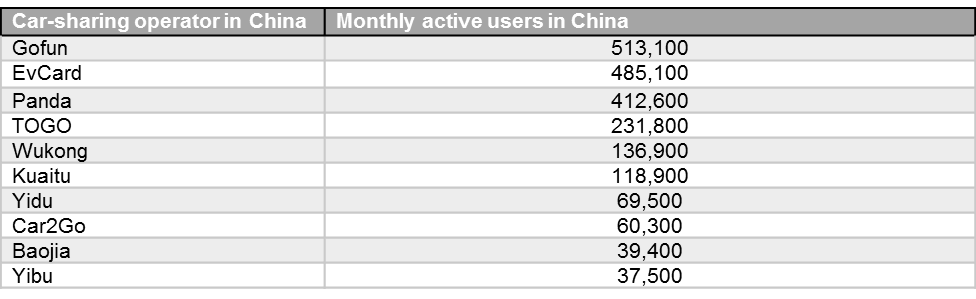

In the following years, the growth of the car-sharing market in China was only slow with a total fleet size of less than 1,000 by 2013. This changed from 2015, when car-sharing in China started to develop. Beginning of 2017, the total fleet size reached 30,000 vehicles, located mainly in Tier 1 and 2 cities. By 2018, there were more than 40 car-sharing operators with more than 40,000 vehicles in China, mainly in Tier 1 and 2 cities. More than 90 percent of them are Chinese players, which are often more likely to get governmental support such as subsidies or license plate acquisition. Currently only Daimler and BMW as international brands have car-sharing fleets in operation. Daimler started its free-floating car-sharing in 2015 in Chongqing. BMW started end of 2017 in a cooperation with EVCARD as “ReachNow Powered By EvCard” in Chengdu, using EVCARD`s shared mobility app, operating 100 BMWi3 at 25 stations, located mainly around premium residential and commercial areas. Other international brands such as GM, Volkswagen and Renault-Nissan-Mitsubishi, are keen on entering the Chinese car-sharing market, which is being expected to reach EUR 1.26bn by 2020. Figure 4 provides an overview of car-sharing operators in China in 2017.

Reasons for the growing role of car-sharing in China

The growth of car-sharing in China is mainly driven by governmental support measures such as guiding and promotion frameworks and subsidy policies and the demands of customers for alternative mobility solutions:

1. Strong government support

- In February 2016, the Shanghai local government set the targets for car-sharing to have 6,000 service spots, 20,000 new energy vehicles (NEV) and 30,000 charging piles by 2020. Further, free parking space was provided to car-sharing operators and subsidies were granted for platform development, charging infrastructure, electricity and operation. Shanghai`s Jiading district is subsidizing car-sharing with gives EUR 5,180 per NEV per year. Similar policies can be found in Chengdu or Wuhan.

- In June 2017, the National Development and Reform Commission (NDRC) released a guideline for the development and promotion of the sharing economy, which is expected to account for more than 10 percent of China`s GDP by 2020. The guideline aims on guiding the balance between encouraging innovation in sharing while regulating the sector and ensuring orderly competition. The call for innovation covers car-sharing as part of the sharing economy, even if car-sharing is not specifically mentioned in the guideline.

- In August 2017, the MoT together with the Ministry of Housing and Urban-Rural Development (MoHURD) released a guiding policy draft for the promotion of car-sharing. The document focuses mainly on legal status, insurance and regular maintenance of cars and sets the use of NEV as shared cars as priority.

2. Citizens needs

- Yet insufficient public transport

Even if massively expanded, visible e.g. through the subway system expansion in Shanghai and Beijing, the public transportation systems in China are still insufficient and often cannot meet the demand, resulting in overloaded systems and low comfort levels. - Limited availability of license plates

In many Chinese cities, license plates are limited. In Shenzhen only one in 300 people with driving licenses can obtain the hard to get license plates needed to purchase vehicles. In Shanghai`s plate auction system only 11,388 out of 244,868 applicants got a plate for an average price of about EUR 11,400. According to Roland Berger, in 2020, there will be 355 million driver license holders but only 195 million passenger cars in China. - Driving restrictions

In cities such as Hangzhou or Beijing, due to traffic control, congestion and air quality control stringent traffic restriction policies are in place. In Beijing, automobiles with end numbers 1 or 6, 2 or 7, 3 or 8, 4 or 9 and 5 or 0 respectively from Monday to Friday are required to refrain from driving. The specific days of road restrictions changes on a quarterly basis. - High costs of owning a car

Compared to owning a car, no purchase and maintenance costs, low service costs (often with discounts cheaper than taxi), insurance and fuel often included, no parking fees. - Limited taxi availability

In particular in rush hours, taxis are often not available and at rail stations or airports there are long queues.

Current challenges for car-sharing market in China

The car-sharing operators in China are under immense pressure, facing strong government requirements, high initial and after sales costs and external costs such as user misbehavior. Additionally in many Chinese cities, the mobility service environment is highly competitive, making it difficult for operators to compete with ride-hailing, taxi services or even bike-sharing. Major challenges for the car-sharing market in China are:

1. High requirements of customers

- Little patience for non-availability

Ease of access to shared cars is a key factor for customer satisfaction, as alternative on-demand mobility services (such as ride hailing, taxis) are readily and cheaply available. - Limited availability of parking spaces also for shared vehicles

In cities like Beijing or Shanghai parking spaces are very limited. When customers are in a rush, they don`t want to loose time while seeking for parking places (free-floating car-sharing). - Need for high service-levels and seamless booking solutions

Customers expect reliable, comfortable and clean cars when driving but they also appreciate a good service environment and 24-hour active support. Very important for customers is the seamless integration of car-sharing services into existing booking platforms (WeChat) and mobile payment solutions (such as WeChat Pay or Alipay). Customers further appreciate offered bonuses or discounts, linking the use of shared mobility services to retail or other services, based on “you have a ride with X and get a discount of Y at Z”.

2. Operational challenges for car-sharing companies

- Local government requirements

Car-sharing operators have to fulfil governmental requirements such as acquiring operating licenses and specific certificates. Operators also have to provide infrastructure such as parking or charging infrastructure, which has a significant cost effect. - High initial investment and after sales costs

The costs for fleet purchase, insurances, after sales maintenance but also car recycling are the major costs for operators. This is reinforced by a lack of synergies with players along the value chain. Further costs related to consumer malpractice such as damaged cars, incorrect parking or traffic violations are a burden for car-sharing operators. - Low utilization rate

According to Roland Berger, the breakeven point for operators is at a utilization rate of around 20 percent, which cannot be reached by almost all of the current car-sharing operators, based on a calculation for a station-based scheme operator with a fleet of 200 cars in a Tier 1 city. The average industry was at 12 percent in 2016. - Competition and pricing pressure

In China, transportation services are relatively cheap. The availability of alternative affordable and convenient mobility solutions (e.g. bike-sharing, ride hailing) results in a high pricing pressure, particularly on short distances, as can be seen in the following figure. In order to win over customers, some car-sharing operators, have started to offer services cheaper than bike-sharing. In Shenzhen, for example, GoFun, a car-sharing platform backed by state-owned Shouqi Group, has put 300 new energy vehicles (NEVs) into service. The rental cost for the cars is EUR 0.13 per kilometre plus EUR 0.01 per minute. On the 3km distance this would be a total of EUR 0.48 and on the 20 km distance a total of EUR 2.96. New customers can even get special deal of EUR 0.13 for three hours of driving. This pricing policy aims on attracting new users and gaining a certain market share.

What is the future of car-sharing in China?

Compared to ride-hailing services, car-sharing in China didn`t take off yet and by today is still a niche market in the shared mobility sector.

Whether China will have 600,000 shared vehicles on the road by 2025, as the consultancy Roland Berger predicts, remains to be seen. This will also depend, how well car-sharing companies will manage the major disruptions and opportunities in the mobility markets, particularly:

1. Advanced technologies

- Electro-mobility

Car-sharing and electro-mobility in China can be considered as two sides of one medal. According to Roland Berger, more than 20 local governments in China have issued regulations related to car-sharing in close correlation with NEV policy. Already today, more than 90 percent of the vehicles for car sharing business are NEVs. This has mainly three reasons: 1. Electric vehicles reduce the operational costs of the operators. NEVs are less expensive to operate than fuel driven vehicles and the purchase of NEVs is supported by governmental subsidies; 2. It is much easier for car-sharing operators to obtain license plates for NEV car-sharing fleets in cities with license plate restrictions; 3. Car-sharing operators see electro-mobility as an advantage, strengthening the perception by customers as “green” and sustainable mobility service providers. Beginning of 2018, Didi Chuxing announced the plan to set up an electric car-sharing platform, including 12 automakers such as BYD Co Ltd. (one of China`s leading NEV manufacturers), Chery, Kia or the Renault-Nissan-Mitsubishi alliance. It can be expected that car-sharing will be further boosted by the establishment of new industry alliances between NEV manufacturers and shared-mobility operators. - Autonomous driving (AD)Today privately owned vehicles have a utilization rate of about 5 percent. A free-floating system based car-sharing vehicle has a five to six times higer utilization rate. AD potentially can lead to a further increase of fleet efficiency. The development and promotion of advanced technologies such as next generation wireless systems (5G), LIDAR (light detection and ranging) technology, charging infrastructure and artificial intelligence as the foundation of demand prediction, fleet management and fleet intelligence are the game changers towards next generation mobility.

In particular when L4 of vehicle autonomy is ready to be applied to shared fleets and reaches a certain penetration level, this will be a disruption to the mobility sector. That means, vehicles are fully self-driving under certain conditions and in full control for the entire trip, such as urban ride-sharing. Cars will become then, even more than they are by today, lifestyle carriers, making the way the target and mobility an “full experience”. A further integration of mobility services and entertainment, leisure, mobile office solutions, e-commerce, gaming and social interaction is to be expected. This is a key driver of the disruption of traditional business patterns and a further growth of platform economy based cross industry alliances. With the penetration of autonomous vehicles into the shared mobility market, there will no need for station based car-sharing anymore. Instead, urban mobility hubs will provide short-term parking and pick up/drop-off spaces for on-demand shuttles and privately owned autonomous cars. Free-floating car-sharing by definition will merge with ride-hailing and taxi-hailing services. However, it is not easy to predict the future regarding AD as well as a concrete timeline for its application in specific contexts and under specific conditions. Whether AD can solve todays urban transport issues or even reinforce them will depend strongly on regulatory frameworks and the question of how exactly the link between AD and shared mobility looks like.

2. Platform economy

- Multi-level service platforms

According to their individual needs, customers can already seamlessly coordinate and book different mobility solutions such as car-sharing, ride-hailing-, public transport- or bike sharing options via MaaS (Mobility as a Service) platforms such as Moovel, Beeline or Whim App. In China, the most popular app for shared-mobility services is Didi Chuxing with about 450 million users and 21 million drivers in China. It operates a ride-hailing app, as well as taxi, minibus and car rental services.

The trend towards next generation MaaS will go from single-sector (such as MaaS as mobility platforms) towards inter-sectoral based platforms. In China, Tencent`s mobile internet platform “Wechat”, which started in 2011 as a mobile messaging app and became the ultimate allrounder app for more than 1bn active users worldwide (of which the vast majority is in China), already offers such All-In-One-App solutions. This means that customers can access a variety of apps within one platform with only one account and can pay services within the platform via mobile payment systems such as Wechat Pay. This includes flight- and train ticket booking, bike- and car-sharing, ride-hailing and other mobility services but also services such as e-commerce, food-delivery, hotel booking or public services and a variety of other functions such as communication, data sharing or gaming. The fact that all these services are accessible with only one user account offers an In-App based tailor-made combination of different service offers and advertisement. Mobility choices will become more influenced by coupon, bonus or discount systems, based on alliances between mobility providers and other service and consumer focused industries. This trend will also have a significant impact on car-sharing operators and offers a new set of additional revenue streams and the exploitation of new multi-stakeholder profit models. - Highly dynamic mobility ecosystems

Multi-level service platforms are the foundation of the changing shared-mobility environment in China. The changes in this environment are mainly driven by the internet behemoths Baidu, Alibaba or Tencent. Companies such as Didi Chuxing (i.a. ride-hailing) or Meituan Dianping (i.a food delivery services), which are backed by the investment arms of Alibaba and/or Tencent, are stepping aggressively into the competitors business areas and start all-out price and investment proxy wars. Didi, the leading ride-hailing service operator in China with a market share of more than 90 percent recently started its own food-delivery service, directly attacking Meituan, one of the leading food-delivery service operators. Didi also recently announced to start a pedelec (pedel-electric) bike-sharing service and by this is directly competing with Mobike (which was recently bought by Meituan) and Ofo (in which Didi itself is invested). Meituan recently started an own ride-hailing service to directly attack Didi Chuxing and bought free floating bike-sharing operator Mobike (the main competitor of Ofo) for USD 2.7bn.

These are just a few examples for the complex environment of China`s dynamic mobility market. In particular, location based services, such as shared-mobility and food delivery services are becoming more integrated with each other and are in the focus of investment battles for the largest customer basis. Other examples are Ctrip.com International, Ltd., which recently obtained a ride hailing license from Tianjin Municipal Transportation Commission to operate ride hailing business in China or Alibaba`s AutoNavi Holdings Ltd., which recently launched its own carpooling business, starting in Chengdu and Wuhan initially with plans to roll out nationally.These dynamic developments are leading to a more diversified but less predictable shared-mobility market. NEV based car-sharing as a part of this environment will be strongly affected by newly emerging cross-industry alliances between the mobility and the energy-, the e-commerce, the retail-, the tourism and leisure- and even the real estate sector.

Summary

China is a trendsetter at the forefront of shared-mobility services. Even if technologies, such as autonomous driving could fundamentally revolutionize transport and mobility in the medium to long run, car-sharing will be an important and integrated part of the shared-mobility ecosystem in China in the near future. If car-sharing operators find ways to operate profitable business models by lowering vehicle production-, operation- and maintenance costs, car-sharing will take off. Cutting-edge technology, innovative and inspiring products and business models tailored to different customer groups, high service standards, commitments to environmental protection and strong cross-industry alliances and partnerships are key to success.

For more information on Car Sharing in China, please also read the report on car sharing in China here. We, the GIZ sustainable transport team in China will further keep you up to date on the latest trends of car-sharing in China!